Beyond Fiduciary Duty: The Strategic Value of Lead Plaintiff Status in Securities Litigation

Topics: U.S. Securities Class Actions, Class Action, shareholder protection, Securities Litigation

"Class actions" in Germany – KapMuG 2.0

Reform of the KapMuG - light at the end of the tunnel?

After a heated debate, the new reform of the Capital Markets Model Case Act (Kapitalanleger- Musterverfahrensgesetz, KapMuG) has finally been passed by parliament and will soon come into force. In the reformed version of the law, which is now no longer time-limited, significant adjustments in the areas of suspension of proceedings and access to evidence point the way towards increased efficiency and the strengthening of the balance between the opportunities afforded to the parties involved in the proceedings (i.e., equality of arms).

Topics: Class Action, germany, KapMuG

DRRT's Global Investor Loss Recovery Conference Mentioned in The D&O Diary

DRRT was delighted to host its 12th Annual Global Investor Loss Recovery Conference in Frankfurt on May 12 and 13. Among the speakers, we were honored to have Mr. Kevin LaCroix, author of the popular The D&O Diary. Mr. LaCroix posted a blog post highlighting his time in Germany. We invite you to visit The D&O Diary.

Topics: Global Loss Recovery, Class Action, conference, corporate governance

Opting Out Of The Class: It May Be The Best Course Of Action

To opt-out, that is the question. An opt-out action is when an investor chooses to remove itself as a class member of a securities class action suit with the intention of filing a direct action against the defendant. There are many reasons why it may be advantageous for an investor to proceed in this manner. As we have had an abundance of experience with direct action opt-outs, if the damages are large enough, this will likely be the best course of action for the institutional investor.

Topics: U.S. Securities Class Actions, Class Action, litigation, institutional investor, claims, Opt-out

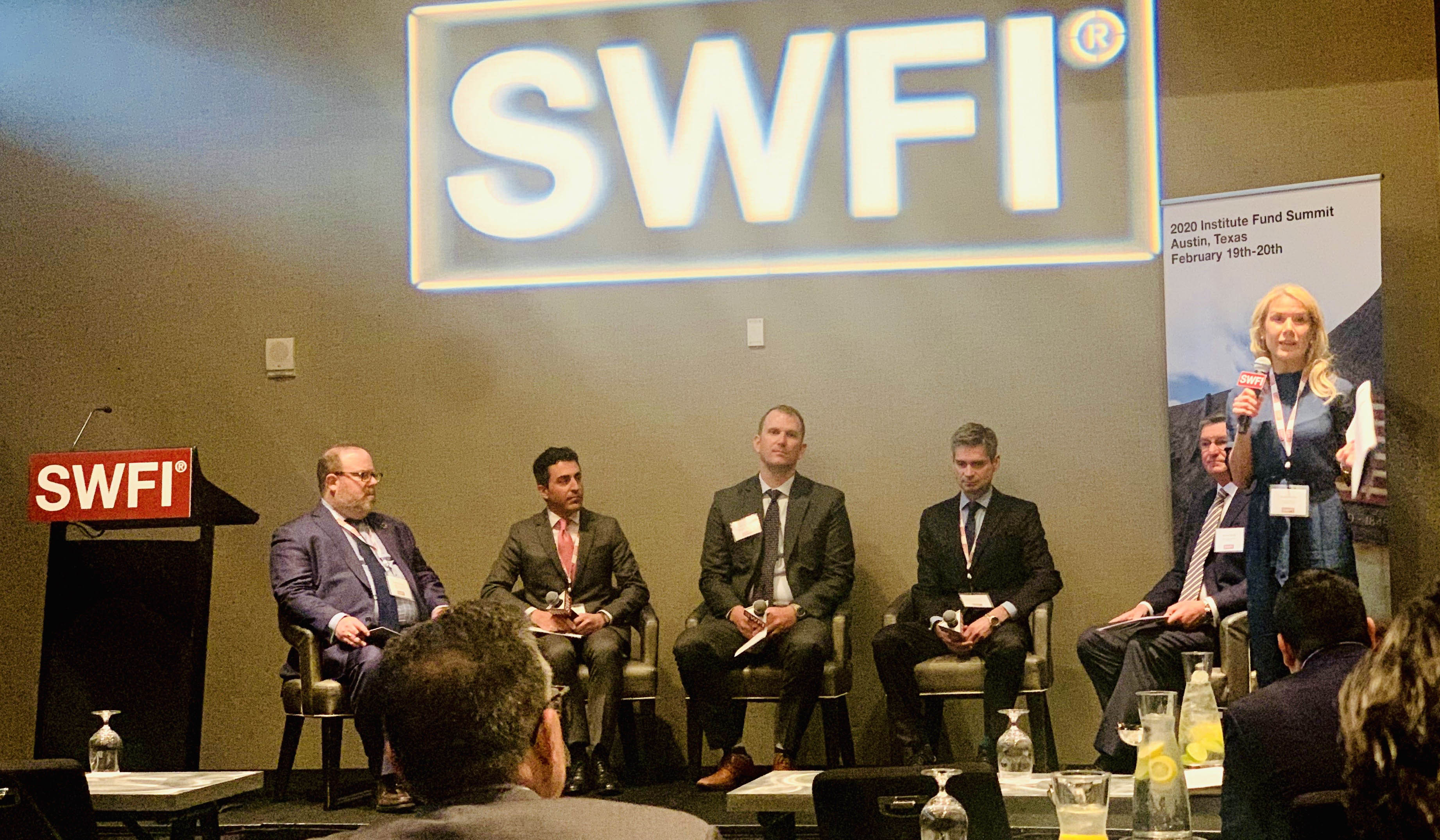

Joseph Gulino speaks at the Sovereign Wealth Fund Institute’s 2020 Institute Fund Summit in Austin, TX

DRRT’s Assistant Managing Partner, Joseph Gulino had the pleasure of speaking at the Sovereign Wealth Fund Institute’s 2020 Institute Fund Summit in Austin, TX. The panel, “Corporate Governance and Shareholder Engagement” discussed some of the corporate governance measures that institutional investors have at their disposal as well as the importance of litigation as a means of shareholder engagement.

Topics: Class Action, shareholders, swfi, stewardship, corporategovernance, ESG, compliance, litigation funding

On Wednesday, April 3, the Italian parliament passed a long-awaited class action law with broad application. The road to the creation of this law has taken many years, and it will not be fully in force until next year. While this is a welcome development for institutional investors in publicly traded companies, it could be significant amount of time before we see any real case develop, particularly relating to securities claims, as the law only apply to events taking place after the entry in force.

Topics: Class Action, Italy

US Supreme Court’s 2018 Decision in Cyan v. Beaver County Employees Retirement Fund

The most important statutes in US securities cases are the Securities Act of 1933 (the ’33 Act) and the Securities Exchange Act of 1934 (the ’34 Act). Whereas the ’33 Act regulates issuers making an initial public offering (IPO), the ’34 Act regulates the secondary market. Thus, largely due to trade volume and investor exposure, the ’34 Act in many respects has much greater reach than the ’33 Act.

Class Actions, Collective Redress and Mandatory Arbitration

Redress - Generally

In modern legal proceedings, different countries and jurisdictions have all had to confront a need to administer a large volume of cases that can arise out of a common set of facts. Often these cases involve relatively few defendants with many thousands of plaintiffs. In the context of investor recovery proceedings, a common circumstance is that a business entity and its directors are accused of wrongdoing (the defendants). Often the defendants’ conduct is alleged to have caused recoverable harm against many injured investors (the plaintiffs). The many investor-plaintiffs largely all share the same injury caused by the related conduct of the same relatively few defendants. In resolving this and similar situations, countries have developed a number of approaches.

Topics: Settlement, U.S. Securities Class Actions, Arbitration, Class Action

New “Class Action” Law in Germany. A Critical Outlook

When on March 14, 2018, after almost 6 months without a government, the two biggest parties in Germany signed their coalition agreement (“Koalitionsvertrag”) and formed the 24th and current government of the Federal Republic of Germany (“Bundesregierung”). Most people paid little attention to a half-page proposal buried on page 124. According to the proposal, the new government would be committed to establishing a class action system in Germany. On May 9, 2018, and with the biggest scandal in German automobile history still fresh in everyone’s mind, the federal government met to discuss a draft proposal leading to a definite law on November 1, a particularly sensitive deadline, seeing as most claims against Volkswagen based on the Dieselgate scandal will expire on December 31, 2018. On June 14, Parliament approved the proposal after very little debate and news agencies have been booming ever since with stories and explanations about the proposed class action system. Sadly, for those familiar with the U.S. model, the current developments from Germany will prove greatly disappointing.

Topics: Global Loss Recovery, Class Action

Collective Redress in Switzerland: Hopes for Consumers but, any Hopes for Investors?

Switzerland as a venue for collective redress litigation:

Although not a member of the European Union, thanks to a series of treaties, Switzerland is a member of the European Single Market, participating in its free movement of goods, services and capital. Additionally, because of the Lugano Convention of 2007, Switzerland also forms part of what could be called a “Single Legal Area” in which court decisions are mutually recognized and executed without need of any special procedure. This frictionless interaction between Switzerland and the rest of the EU, combined with the world-renowned Swiss efficiency and discretion, has made the country a great venue for litigation, especially as regards to civil and commercial arbitration.

Topics: Global Loss Recovery, Class Action